It’s not here yet, but you should know about some of the changes you’ll see in income tax laws for 2026 – and for 2025.

You haven’t even begun working on your 1040 for 2025 yet. Why would you start thinking about the 2026 tax year?

The answer is simple: You’ll see more changes in the 2026 tax code than you’ve seen for many years. Dubbed the One Big Beautiful Bill, these new tax provisions may well have impact on the income taxes you’ll file in 2027. Forewarned is forearmed. If you know now that a particular change will affect you next year, you can plan accordingly.

We’ve talked before about the importance of year-round tax planning. Maybe this new information will prompt you to get serious about that in 2026. We’re available to consult with you anytime during the year, not just at tax preparation time. Here are some notable changes that came out of the OBBB which may affect you next year.

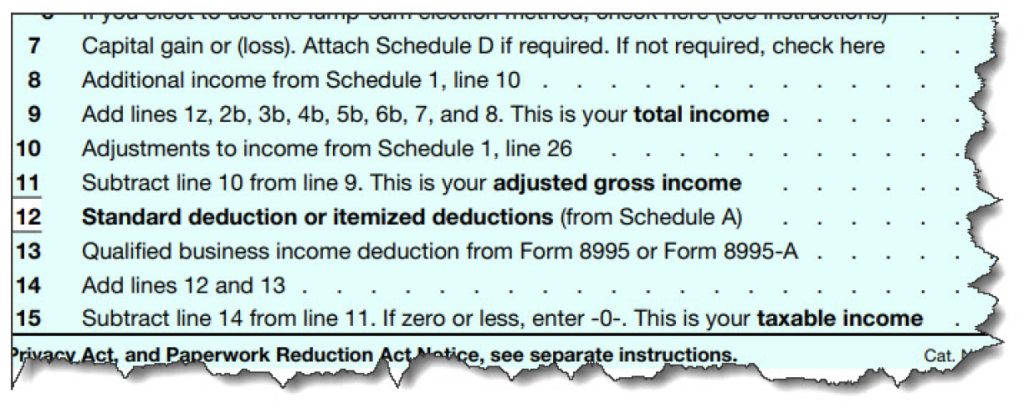

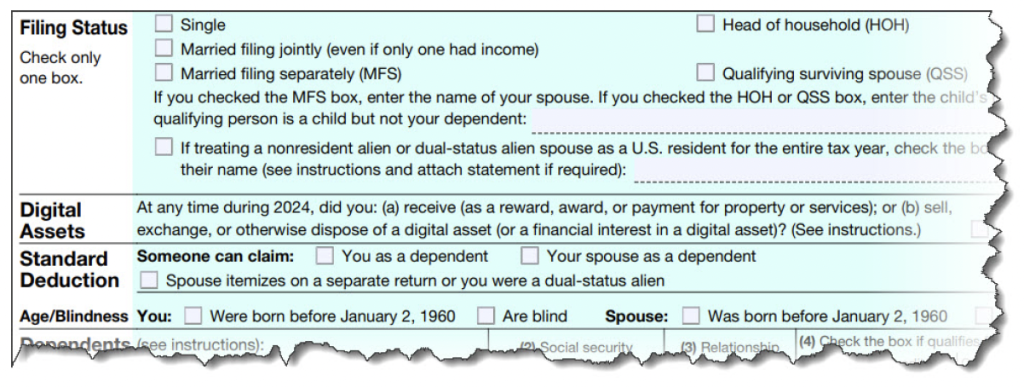

Standard Deduction

The standard deduction for tax year 2026 will increase from $31,500 (2025 tax year) to$32,200 for married couples filing jointly. For single taxpayers and married individuals filing separately, it increases from $15,750 to $16,100 for tax year 2026. Heads of households will see a standard deduction of $24,150, up from $23,625 for tax year 2025.

Marginal Rates

For tax year 2026, the top tax rate remains 37% for individual single taxpayers with incomes greater than $640,600 ($768,700 for married couples filing jointly). The other rates are:

- 35% for incomes over $256,225 ($512,450 for married couples filing jointly)

- 32% for incomes over $201,775 ($403,550 for married couples filing jointly)

- 24% for incomes over $105,700 ($211,400 for married couples filing jointly)

- 22% for incomes over $50,400 ($100,800 for married couples filing jointly)

- 12% for incomes over $12,400 ($24,800 for married couples filing jointly)

- The lowest rate is 10% for incomes of single individuals with incomes of $12,400 or less ($24,800 for married couples filing jointly)

(Courtesy Internal Revenue Service)

Other Changes for 2026 Tax Year

Alternative Minimum Tax Exemption Amounts. The exemption amount for unmarried individuals is $90,100 and starts phasing out at $500,000. It’s $140,200 for married couples filing jointly. This exemption begins to phase out at $1,000,000.

Estate Tax Credits. There is a basic exclusion amount of $15,000,000 for estates of decedents who die during 2026. This is an increase from a total of $13,990,000 for estates of individuals who died in 2025.

Adoption Credits. For tax year 2026, the maximum credit equals the amount of qualified adoption expenses up to $17,670. This is up from $17,280 for 2025. The amount of credit that may be refundable is $5,120 for tax year 2026.

Employer-Provided Childcare Tax Credit. This is significant for those affected. The OBBB greatly improves an important employer credit for tax year 2026. It increases the maximum amount of employer-provided childcare tax credit from $150,000 to $500,000. If the employer is an eligible small business, it increases to $600,000.

Some Temporary Changes

The OBBB includes some tax code revisions that are in place for the 2025-2028 tax years. You may have already heard about at least some of them, but we’ll review them here.

Senior Deduction. In addition to the existing additional standard deduction for seniors, individuals aged 65 and older may claim another deduction of $6,000. This is available whether you itemize or not. The deduction is per eligible individual. So it would be $12,000 total for a married couple if both qualify. This deduction phases out for taxpayers with modified adjusted gross income over $75,000, or $150,000 for joint filers. Individuals must file jointly if they are married.

No Tax on Tips

Employees and self-employed individuals can deduct qualified tips received in occupations listed by the IRS as eligible. The maximum annual deduction is $25,000, which can be reported on a W-2, 1099, or Form 4137. The deduction is available for both itemizing and non-itemizing taxpayers.

No Tax on Overtime

If you receive qualified overtime pay, you can deduct the compensation that exceeds your regular rate of pay. For example, this would refer to the “half” portion of “time-and-a-half” that’s required by the Fair Labor Standards Act (FLSA) and reported on income tax forms like the W-2,1099, and other official statements. The maximum annual deduction is $12,500 ($25,000 for joint filers), and taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers) are not eligible. This deduction can be claimed by both itemizing and non-itemizing taxpayers.

No Tax on Car Loan Interest

This deduction has many qualifications. We can help you determine whether you’re eligible. Basically, you can deduct interest if you’ve taken out a loan used to purchase a qualified vehicle. The deduction is only allowed if the vehicle is purchased for personal use and meets other eligibility criteria. For example, it’s not available for leased vehicles, and it must be secured by a lien.

Almost Tax Time

By the time you see next month’s column, you’ll be waiting for your W-2s and 1099s and other tax documents to start coming in. 2025 tax preparation is just around the corner, and we hope you’ve done some planning for this annual task already. If you haven’t, and/or you’re going to need help preparing your taxes, please let us know as soon as possible so we can set up an appointment for after your forms come in.