Here are some actions you can take now to whittle away at your 2025 income tax obligation.

Here comes December. You know what that means. You’ll be busy trying to clean up your 2025 accounting activity, using what you’ve learned about your finances for the last 11 months. You may be trying to budget for 2026. You probably have holiday plans, gifts to buy and cards to send and gatherings to plan for and attend. At the same time, you must get your regular daily work done.

We hate to add to your lengthy to-do list, but November is a good time to consider taking actions that will reduce your 2025 tax liability. If you haven’t done any tax planning for the current tax year yet, that’s OK. The goal is to make financial moves that will in all likelihood provide welcome relief when you sit down to tackle the 1040.

Some of these will cost money, but others won’t. All should have impact on your taxes. If you’re aggressive enough, it could mean the difference between owing the IRS and getting a refund. Here’s what we suggest.

Pay Your Future Self

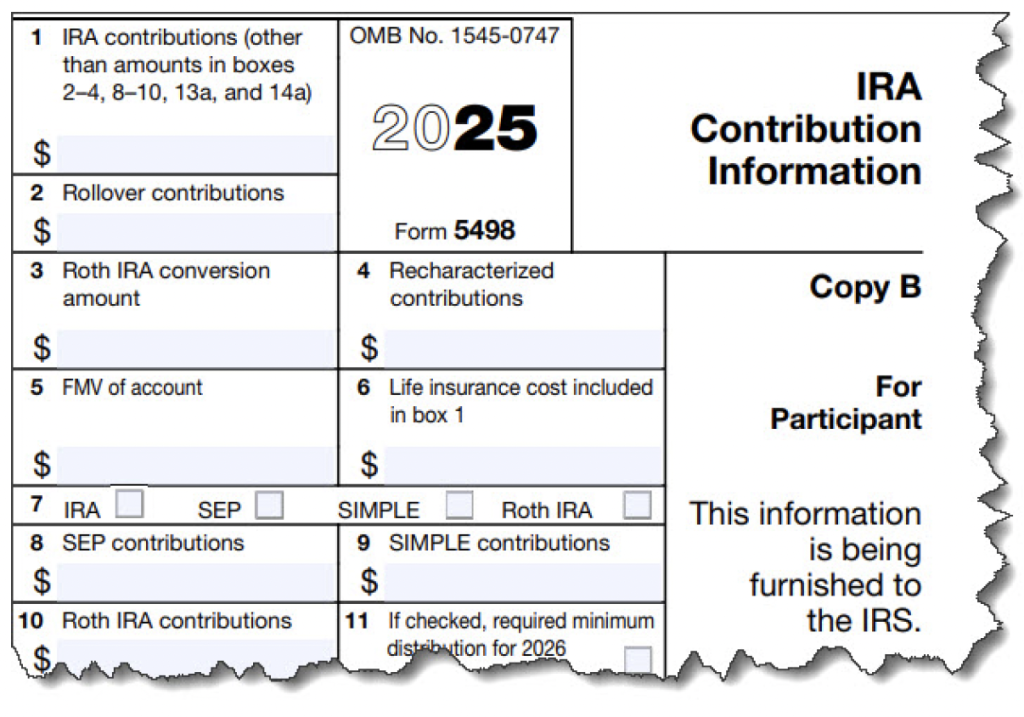

You know what we’re talking about here: your retirement savings and investments. If you’re already maxing out your contributions to your 401(k) and your IRA, you’re good here. But if you’re not, think about doing so. We know it’s late in the year, but every little bit you do will move the needle.

Some retirement vehicles take some time to set up, but you can at least start an IRA if you haven’t already. You must have earned income to open either a traditional or Roth IRA. The maximum you can contribute for 2025 is $7,000, $8,000 if you’re age 50 or

over. You’ll have until April 15, 2026, to fund it fully.

If you absolutely don’t have the time or the funds right now, consider it in early 2026. Self-employed? There are still tax-advantaged retirement accounts you can contribute to. We can help you explore these.

Move Some Income Into 2026

If you’re a gig worker, independent contractor, or other self-employed individual, you will find this easier than W-2 employees. If your estimated income for 2025 is running high and your expenses are low, it’s worth doing if you can. Of course, anyone who receives a 1099 for services provided can’t do this, but maybe slow down your billings for the rest of the year if you have some control over them. W-2 employees who are anticipating bonuses or commissions might see if they can be delayed until 2026.

Analyze Your Inventory

If you create inventory reports in accounting software on a regular basis, this shouldn’t be too difficult. If not, do what you can to evaluate what’s been selling this year – and what’s not been. This is especially important if your sales have been good in 2025 and your income is up.

What has been selling well? Whether or not you’re scheduled to purchase more of those items this year, consider doing so in order to pay before December 31 and claim the expense on your 2025 taxes. You may need more expenses to offset the revenue.

On the other hand, do you have money tied up in inventory that just isn’t selling, and you could use some more income in 2025? Think about discounting those products to get them off your books and bring in some quick sales.

Look for Potential Deductions

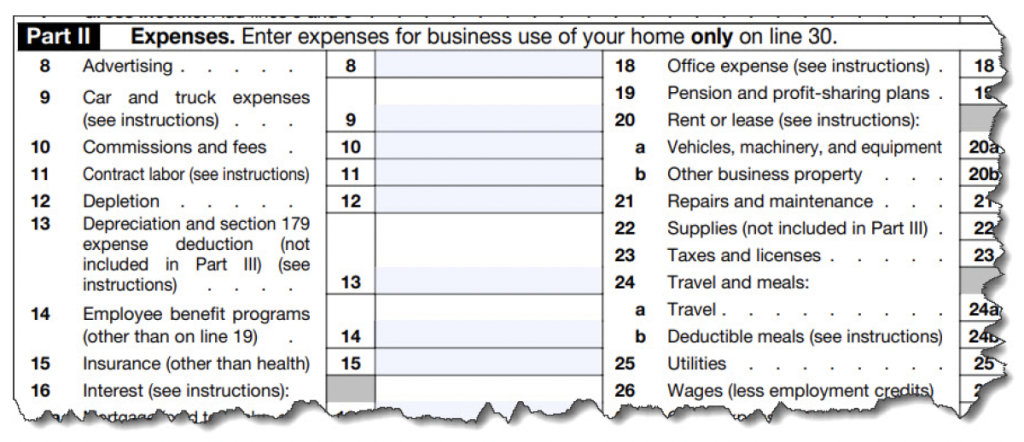

If you’re a sole proprietor, you know that you have to complete and file an IRS Schedule C (Profit or Loss From Business) with your 1040. This rather complicated form

asks all about your business income and expenses. One way to minimize your tax liability is to claim as many legitimate expenses as you possibly can.

There’s some gray area when it comes to claiming business expenses on Schedule C. Make sure that what you’re claiming is ordinary and necessary for your trade or profession, which is part of the IRS’ definition. We can give you some general guidelines as you go through your business-related purchases for 2025, but we can’t tell you for a fact whether a specific expense would be accepted by the IRS. Your expenses are only scrutinized if you’re audited. You just provide totals for each type of expense on your Schedule C.

If you are ever audited, the IRS will expect to see detailed documentation for the purchases you claimed were related to your business. So it’s critical that you document your expenses carefully by saving paper and digital records of receipts, credit card statements, bank statements – anything that will prove you made the purchase. You’ll also have to explain why.

Buy Something Big

If you can afford to make a major purchase of something business-related you’ve been needing, that can knock your tax bill down significantly in some cases. You can either depreciate the item or claim a Section 179 deduction. We can help you determine which would be better for you and help with the calculations. In fact, we can take over the whole job of tax preparation if you’d like. Call us to schedule an appointment for after you’ve received all of your tax documents in early 2026. We’ll be happy to help.